At this point you’ve learned what it takes to buy a house. Now it’s time to get prepared to do so.

Here’s your financial checklist:

Pay down your debt.

The bank or lender wants your total debt to be no more than about 38% of your income.

If your income is $5000/mo. then the bank or lender figures your total debt can be $1900/mo. But if you already have $1500/mo. in debt, then you have only $400/mo. left for mortgage payments.

Pay down your debt as much as possible to increase your borrowing power. Pay down the highest-interest debt first (credit cards) before lower interest debt (car loans, student loans).

Once you pay off your credit cards get in the habit of paying them off every month and never carry a balance. Few things can kill dreams of home ownership better than credit card debt.

Pay down that debt! If you have a hard time paying down your debt then use the technique advocated by Charles Givens: Pay Yourself First.

Every time you get a paycheck, take a portion of that paycheck and apply it towards your goal of paying down your debt first.

If you wait to take care of everything else first you may never have anything left over to pay down your debt with.

Down payment

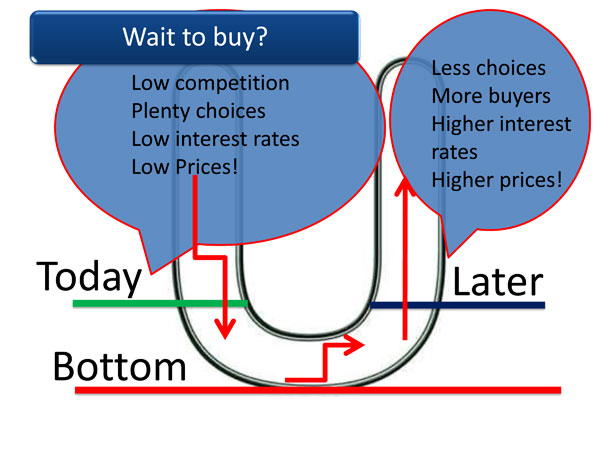

Get the down payment together. If you don’t already have a down payment saved, start saving now. The sooner the better.

If you have a hard time saving then use the Pay Yourself First technique mentioned above: Every time you get a paycheck, put a portion in your savings account first.

Pay yourself first so that money is saved. It may help to have a separate account for your down payment, so it’s easy to see its size completely separate from any other savings you may have.

Remember, having a sizable down payment is the #1 factor in being able to qualify for a loan — especially being able to qualify for a bigger loan.

Credit

Clean up your credit report. Good credit not only helps you qualify for a loan in the first place, it helps you get a better deal when you do get a loan.

Get familiar with your credit report and find out how to improve your credit. Working with a good loan officer can help you in this area.

By applying the techniques of paying down debt, getting the downpayment together and cleaning up your credit, you will be in the best position possible to get the home of your dreams!

Call Howard Dinits R(B)

Call Howard Dinits R(B)

808-874-0600

toll free 877-434-6487

Dinits Realty

Howard@HowardDinits.com

https://easymauirealestate.com

Want to receive email alerts with listings of condos or homes for sale?

Sign up today at https://idx.easymauirealestate.com/idx/search/emailupdatesignup

You can now Search Maui Real Estate For Sale by Price

Please try the 1 click search

Leave a Reply